According to the report, the Seattle Area (King County) reported 293 foreclosures during the third quarter. This was well below the 1533 foreclosures which took place in Los Angeles. When the number of foreclosures is compared to the number of households, New York City far and and away boasted the lowest rate of foreclosures, with only .01% of homes going to Trustee Sale.

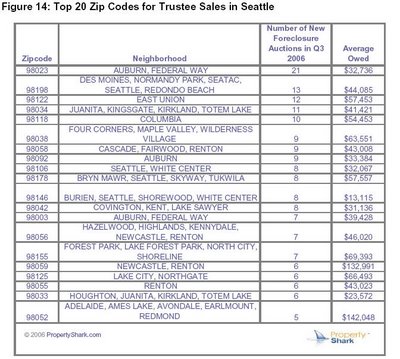

By studying King County in depth, we find that Auburn and Federal Way, two of the least expensive places to live in King County, experienced the highest number of foreclosures.

Many feel that foreclosure rates will rise in 2007, as tens of thousands of Adjustable Rate Mortgage's fixed terms expire.

Now the stage is set. The nation’s foreclosure total already broke the 1 million glass ceiling in October, and just how high foreclosure levels will go in 2007 is open to

debate depending on how steep one believes the downturn will be.

“When I got into this business, back in 2000, defaults were about 1percent of all first mortgages. Today we’re at 1.5 percent. While it’s not a large number, it’s still a significant move. Do I think the economy is going to crumble? No! Will (the foreclosure rate) go to 2 percent? We’ll have to wait and see,” Saccacio told Doti, an economist and president of Chapman University.

For Esmael Adibi, executive director of the A. Gary Anderson Center for Economic Research at Chapman University, the key concern is all those people who signed up for those “exotic” adjustable-rate mortgages in 2005 and thereafter. In California, for example, 27 percent of all mortgages were so-called “option ARMs,” where the buyer pays 1 percent interest and the underpaid amount gets added to the loan’s principal. (Foreclosure Pulse, 2006, Para. 2-4)

Despite these nationwide scares, Seattle has remained fairly resiliant to busts in the housing market. Will this be able to continue into next year or will next year bring a housing market disaster? I suppose I'll leave it to my friends over at Seattle Bubble to debate that.